INTRODUCTION

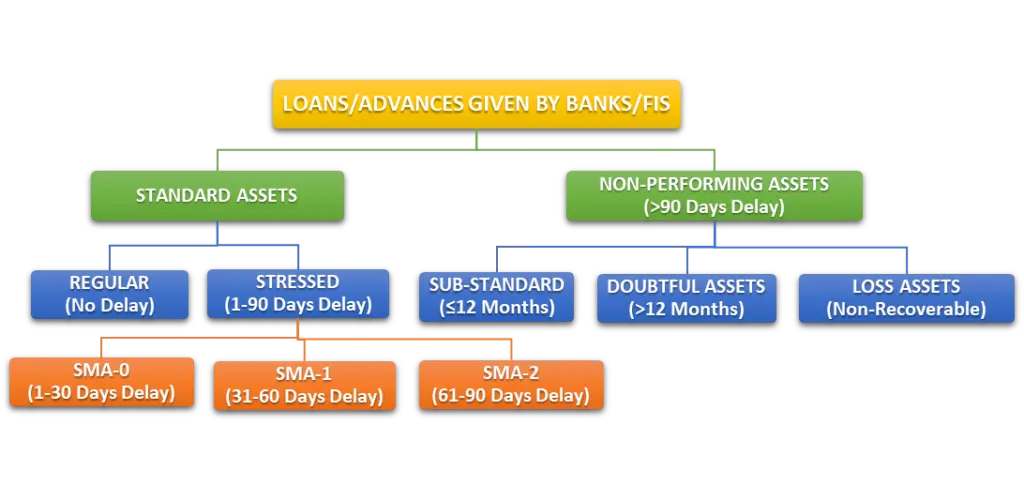

Public sector banks are significant part of banking sector as they are responsible for credit distribution in large scale across the country. One of the major challenges faced by these banks has been the increase in the level of non-performing assets (NPAs). Before moving further let’s understand ‘What are NPAs’, basically NPA’s are loans that have stopped generating income in the form of repayment for the bank, this is when the borrower has defaulted on the interest or principal payments for more than 90 days. This buildup of bad debts weakens and majorly affects the banks financial health and eventually it limits bank’s ability to lend and poses a serious risk to economic growth of India.

As per the Reserve Bank of India (RBI), the gross NPAs in Indian banks, particularly in public sector banks is around 400,000 crores. Public sector banks account for nearly 90% of total NPAs in India, with private sector banks covering the remaining portion. To deal with NPA in depth and tackle its recovery process, the government came up with the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act (SARFAESI Act) in 2002. This act was introduced to give banks and other financial institutions the power to recover their loans more efficiently and accurately, by avoiding lengthy court procedure of recovery. This act’s recovery process allows banks to sell or auction assets that borrowers have pledged as collateral, the SARFAESI Act provides comparatively a faster and more direct approach to address NPA’s.

This blog examines the impact of the SARFAESI Act, 2002, on the recovery of non-performing assets in public sector banks. Through this critical analysis the author will analyze the financial health of public sector banks and analyze the recovery process and will go forward by reviewing the challenges faced by banks, this study seeks to determine whether the SARFAESI Act has effectively mitigated the NPA or there are any reforms required.

OVERVIEW OF NPA RECOVERY PROCESS IN PUBLIC SECTOR BANK

Prior to the introduction of the SARFAESI Act, 2002 the method of recovering Non-Performing Assets (NPAs) from borrowers used to be very cumbersome and time-consuming process. For initiation of recovery process banks had to approach the civil courts, initiating by issuing notices, followed by a trial, and eventually court passes a decree. However, even after passing this decree, the process doesn’t get over. The decision of the court can be appealed and this prolongs the process of resolution for years. And after the final decree is passed the enforcement would commence by filing an Execution Petition (E.P.). The Executing court would then proceed to auction the debtor’s or guarantor’s assets. And this long process makes the recovery uncertain and largely affect the financial health of the country. Keeping these challenges in mind the SARFAESI Act of 2002 was introduced on the recommendation of the Narasimham Committee II’s coming up with more simplified method, which allows banks to confiscate and sell defaulters’ assets without requiring court intervention, this legislation completely transformed the way non-performing assets (NPAs) were recovered.

NPA RECOVERY PROCESS

Lok Adalats

Lok Adalat are informal courts established to deal with disputes by way of conciliation and compromise and mainly focus on mediating between borrowers and lenders. They often deal with loans of up to Rs. 20 lakhs. Lok Adalat, decision is final and binding on the parties to the dispute, provided both parties agree. But the major issue with these Lok-Adalats is that they are suitable for small loans and cases where both parties are willing to negotiate and henceforth the recovery rate is often low since the settlements may involve waivers and concessions.

Corporate Debt Restructuring (CDR)

The Corporate Debt Restructuring (CDR) is a NPA recovery process for large corporate borrowers under financial stress, it is a voluntary non- statutory mechanism which allows the restructuring of loans. Under CDR recovery process, the borrower and lenders collaborate to devise a feasible plan for repaying the loan, which could include extending repayment timelines, reducing interest rates, or converting debt into equity. However, CDR is considered beneficial only for large corporations, and its success depends on the borrower’s ability to repay loans during financial difficulties. In many cases it is overserved that, restructuring may not resolve the root cause of distress, leading to eventual default or liquidation.

Debt Recovery Tribunals (DRTs)

Debt Recovery Tribunals came into existence by virtue of Recovery of Debts Due to Banks and Financial Institutions Act, 1993 (RDDBFI Act), the main idea was to speed up the recovery process for unsecured loans. DRTs provides an expedited procedure for financial institutions to recover debts above Rs. 20 lakhs. The idea behind this was to resolve cases within six months instead of stretching for years. However, if we analyze the limitation pertaining to DRTs, we will get to know that these tribunals suffer from infrastructural bottlenecks and manpower shortages, which results in delays in resolving disputes. Moreover, these tribunals handle both secured and unsecured loans which increases their workload and takes long time to resolve disputes.

SARFAESI Act, 2002

The Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act of 2022 was brought with an aim to enable banks and financial institutions to make recovery procedure more simplified by avoiding the lengthy court recovery procedure. This legislation primarily applies to secured loans which allows lenders to take control of the assets pledged in the form of security and sell them when borrowers default repayment of debts. A notable aspect of this legislation is that it provides three different methods for recovery of NPAs which are as follows: –

- Securitization

Securitization is a recovery mechanism which allows banks and financial institutions to pool assests to Asset Reconstruction Companies (ARCs), which thereby results in interest making securities and altogether recovering these loans. The securitization process under the SARFAESI Act is very dynamic yet systematic, and the following steps lays down the detailed step wise breakdown of Securitization process: –

| Step | Explanation |

| 1. Identification of NPA | At the initial stage banks identifies debts which are unpaid and are turning into non-performing assets (NPAs). |

| 2. Asset Transfer to ARC | The bank transfers these NPAs to an Asset Reconstruction Company (ARC). The ARC is responsible for managing and recovering the bad debts. |

| 3. Issuance of Security Receipts | The ARC issues Security Receipts (SRs) to investors or the original bank, representing a share in the asset pool (NPA). The investors are paid returns based on the recovery of the bad assets. |

| 4. Recovery or Reconstruction | The ARC attempts to recover the NPA or reconstruct the loan by restructuring the payment schedule, or in extreme cases, by selling the assets. |

| 5. Cash Flow to Investors | As the loans are recovered, the investors in the SRs receive returns. If the loan is not recovered, the investor bears the loss. |

- Enforcement of Security without intervention of the court

The SARFAESI Act, 2002 empowers banks and financial institutions to enforce security interests without the interference of the court. Meaning thereby that in case borrower defaults on repayment of loans, the lender can directly seize and sell the secured assets to recover debts, without approaching court of law for recovery of debts.

Following is the detailed procedure for enforcement of Security laid down in SARFAESI Act: –

| Step | Process | Description |

| 1 | Loan Default | When borrowers fail to repay loans resulting into NPA after

90 days of default. |

| 2 | Issue of Demand Notice | After the default Lender issues a demand notice u/s Section 13(2) to the borrower demanding repayment of loan within 60 days of receiving the Demand Notice. |

| 3 | Representation of borrower | On receiving the demand notice borrower can respond to the notice and can raise objections. |

| 4 | Lender’s Response | In case any objections are raised the Lender reviews the objections and must respond with reasons for acceptance or rejection within 15 days. |

| 5 | Taking Possession | If no repayment is done within the given period of 60 days, lender can take possession of the secured asset u/s Section 13(4). |

| 6 | Sale of Secured Asset | Lender can sell the assets to recover the dues through auction or private sale. |

| 7 | Appeal by Borrower to DRT | Borrower can appeal to the Debt Recovery Tribunal within 45 days if there is any dispute with the actions or sale. |

| 8 | Further Appeal to DRAT | If borrower is not satisfied with the DRT order he can approach the DRAT by appealing the order. |

| 9 | Settlement of Sale Proceeds | After the sale of the assets, the proceeds are used to cover the lender’s dues, and any excess is returned to the borrower. |

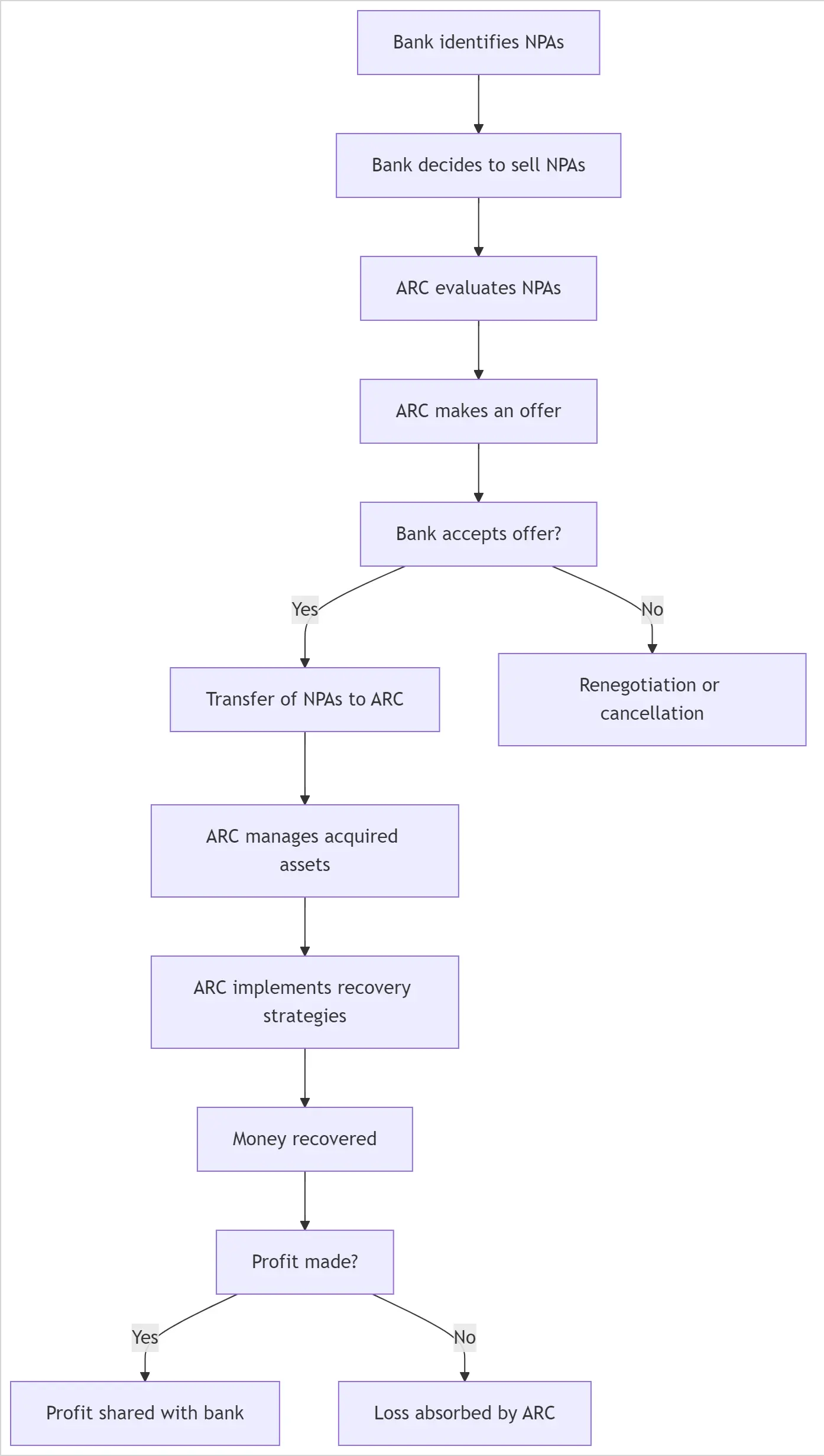

- Asset Reconstruction

Asset Reconstruction is another way for recovery of NPAs, in this process a specialized entity called as Asset Reconstruction Company (ARC) purchases the non-performing assets (NPAs) from financial institutions like banks and tries to recover the dues or manage the assets by disposing it for profitable interest which thereby leads to the recovery of NPA. The following flow chart lays down the ARC process: –

Challenges Faced by SARFAESI Act

- The SARFAESI Act enabled banks the power to transfer the responsibility of recovering bad loans to specialist organizations, allowing them to improve their balance sheets. At first, these organizations—Asset Recovery Companies, or ARCs—were successful in obtaining amount of money greater than what debtors were prepared to provide, which allowed non-performing assets (NPAs) to be resolved more quickly. It was eventually found, that though ARCs were paying tremendously low rates for assets and, in certain situations, selling them back to the original promoters or relatives.

- Concerns concerning ARCs assisting defaulters repurchase their assets at discounted rates were brought up in a May 2010 meeting called by the Central Vigilance Commission (CVC) and attended by officials from the Indian Banks Association (IBA), representatives of the Central Bureau of Investigation (CBI), and heads of several banks. These ARCs would purchase properties from banks at minimal price and then resell them to the initial borrowers at a higher price.

- Banks, however, have discovered that when they commence recovery proceedings under the SARFAESI Act, debtors tend to respond more positively. Banks encounter a noteworthy obstacle in the form of debtors frequently approaching Debt Recovery Tribunals (DRTs) in an attempt to seek relatively easy stay orders on asset sales. Banks, however, maintain that SARFAESI has proven to be more successful than alternative legal measures. Many officials from banks believe that rather than depending entirely on ARCs, they may get better results by establishing their internal recovery divisions.

Recovery Percentage through Various Channels (2008-2014)

Conclusion

The SARFAESI Act of 2002 has played a significant role in dealing with NPAs recovery in public sector banks however, the impact of the act has also led to certain challenges in banking sector. As India’s banking sector continues to evolve and is in large very dynamic in nature, the SARFAESI Act requires further refinements to address emerging challenges faced by the banks due to changing economic landscapes. The Act’s journey from its introduction to its current application demonstrates the dynamic nature of its limitation when it comes to its application and the need for continuous adaptation to meet the complex challenges of NPA management in a rapidly changing global economy.

Author: BHUMI SHARMA, A Student at SYMBIOSIS LAW SCHOOL, NAGPUR, in case of any queries please contact/write back to us via email to chhavi@khuranaandkhurana.com or at Khurana & Khurana, Advocates and IP Attorney.

References: –

- dbie.rbi.org.in

- Centre for Public Policy Research- “The Report on Banking Reforms, 1991, submitted to the Government of India”

- “Begenau, J., Piazzesi, M. and “Schneider, M.(2015). Banks’ Risk Exposure, National Bureau of Economic” Research, NBER Working Paper No.21334”.

- “Sing, J. (2013). Recovery of NPAs in Indian Commercial Banks, International Journal of Transformation in Business Management, Vol. 2, No. 3, pp. 77-95”.

- “Uppal,“K. R. (2016). Priority Sector Advances: Trends, issues and strategies”, Journal of Accounting and Taxation, Vol. 1, No.5, pp. 79-89”.

- Vikas and Tandon Sunman, “Performance Evaluation of Public Sector Banks in India”, Asia Pacific Journal of Research in Business management, Vol.1, No.1, October 2010, pp.1-17”

- “Goyal Kanika, “Empirical Study of Non-Performing Assets Management of Indian Public Sector Banks” Asia Pacific Journal of Research in Business Management, Vol.1, No.1, October 2010, pp.114- 131”. https://www.thehindubusinessline.com/money-and- recover-more-in-fy18-viaibc-sarfaesi-act/blog 25853717.ece

- Arora, Usha, “Vashisht, Bhavna and Bansal, Monica, An Analytical Study of Growth of Schemes of Selected Banks (March 26, 2009). The Icfai University Journal of Services Marketing, Vol. VII, No. 1, pp. 51-65, March 2009.

- “Mukund P Unny “A Study on the Effectiveness of Remedies Available For Banks in a Debt Recovery Tribunal – A Case Study on Ernakulam DRT”: Centre for Public Policy Research”.

- “B.Selvarajana , G. Vadivalagan, P” International Journal of Finance & Banking Studies 2013 Volume 2”. “Mr.Vinod Kumar, & Dr. Rajiv Khosla. (2017). IMPLEMENTATION AND IMPACT OF SARFAESI ACT 2002. International Education and Research Journal (IERJ), 3(5). Retrieved from https://ierj.in/journal/index.php/ierj/blog /view/863

- “RBI: Report on Trend and Publications, New Delhi of Banking in India (Annual Issues) (Various Issues)”

- “Khosla, R. and Kumar,V. (2017).Implementation and Impact of SARFASEI act 2000,Intenational Education and Research Journal, Vol.3,Issue. 5, pp. 244-247”

- “Bhuyan, R., and Rath, A.K. (2013). “Management perspective of Non-Performing Assets: A challenge for Indian Banking sector in the post economic reform Era, The Orissa Journal of Commerce, Vol. 34, No. 1, pp. 93-107”. “Sing, N. R., Modiyani, A. R. and Salunkhe, A. H. (2013). Impact of Recovery Management on NPA: a Case Study of Bank of Maharastra, Indian Journal of Applied Research, Vol. 3, No. 5, pp.458-460”.

- “Kaveri V.S., Faculty, National Institute of Bank Management, Pune,” Prevention of NPAs– Suggested strategies” – IBA Bulletin, August 2001”.

- Karunakar, M., “Are non – “Performing Assets Gloomy or Greedy from Indian Perspective”.