INTRODUCTION

The Companies Act regulates the formation of the company. The Companies Act, 2013 consolidates and amends the law relating to the company.[1] This act is the result of the Companies (Amendment) Bill 2019 which Lok Sabha passed. This act has 470 sections and 7 schedules. It applies to all over India. The First Companies Act was passed in 1956 on the recommendation of the Bhabha Committee. This act was administered by the Ministry of Corporate Affairs.

In this article, we will discuss the Companies Act, 2013, especially Section 179 of the act which talks about the “Powers of the Board.” Some examples of the powers are the power to borrow money and invest the company’s funds. It is important to understand the power of the board.

BRIEF ANALYSIS OF THE ACT

We have already discussed the number of sections and schedules given in this act. Also discussed the applicability of the act. Now, we will discuss the important sections of the act.

DEFINITION: – For the convenience of the reader the act also provides the definitions of various words that are used in the act. The definitions are given in Section 2 of the act, which is also known as the definition clause.

The act defines “Board of Directors” or “Board” as the collective body of the director of the company.[2] In this article, we will discuss the power of this board. Instead of this definition, it defined 94 more words. The definition clause defined the 95 words.

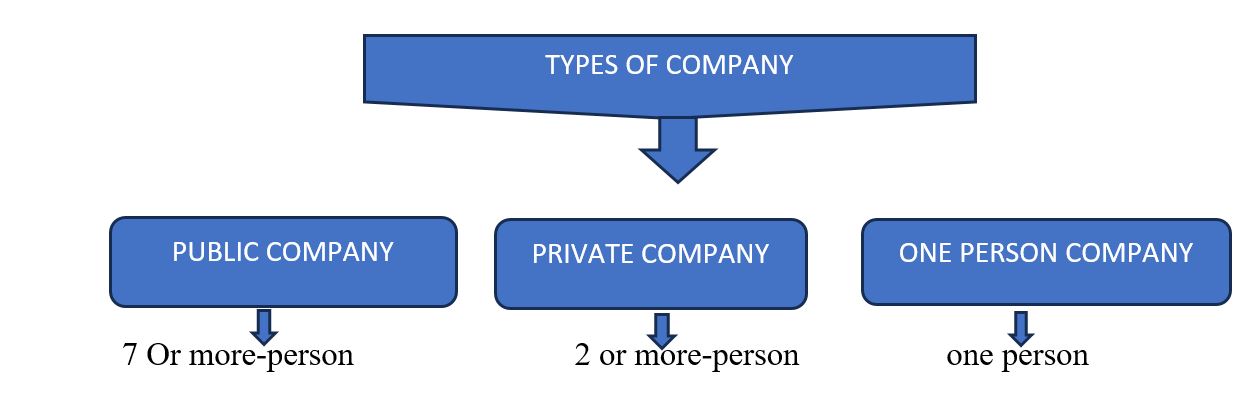

FORMATION OF THE COMPANY: – It is given in chapter 2 and section 3 of the act. It says that the company may be formed for the lawful purpose by: –

The exception of a one-person company is that if anyone wants to establish a one-person company, he has to name another person in his/ her company’s document. This person will take all the responsibility in case of the death of the real owner and in incapacity to run the company by the real owner. Written consent of such person shall also be submitted in the registrar’s office at the time of incorporation of this one-person company. The person can also withdraw the consent in a prescribed manner.

INCORPORATION OF COMPANY: – It is given in section 7 of the act. All the important documents for the registration shall be submitted to the registrar’s office of the area where the company is situated. The documents required include: – a memorandum and articles of the company, a declaration, an affidavit from each of the subscribers to the memorandum, an address for correspondence, etc.

PROHIBITION ON ACCEPTANCE OF DEPOSITS FROM THE PUBLIC: – No company will invite, renew, or accept deposits from the public after the commencement of this act. This is allowed only in a manner provided under this act. This provision will not apply to a banking company and nonbanking financial company as defined in the Reserve Bank of India Act, 1934 (2 of 1934) and to such other company as the Central Government may, after consultation with the Reserve Bank of India.[3] Section 73 of the act deals with this matter.

CORPORATE SOCIAL RESPONSIBILITY: – A company that has a net worth of five hundred crores or more, or turnover of rupees one thousand crores or more, or a net profit of rupees five crores or more[4] shall constitute a Corporate Social Responsibility Committee of the Board during the financial year. The board shall consist of three or more directors.

APPOINTMENT OF AUDITORS: – A company shall appoint an auditor at the first annual general meeting. Proviso that before the appointment of the auditor written consent is necessary.

DETAILED ANALYSIS SECTION 179

SECTION 179(1): – The section 179 of the act talks about the powers of the board. It says that the board of directors of the company can exercise all the powers, and do all the things which are required for the exercise of the company. However, it will follow all the relevant laws, memorandum, or articles, follow all other regulations that are not in conflict with the company act.

SECTION 179(2): – If the company made any regulation in a general meeting, that regulation should not invalidate any prior decision of the board. The prior decision would be valid.

SECTION 179(3): – The board of directors shall follow the following powers[5] on behalf of the company: –

- to make calls on shareholders in respect of money unpaid on their shares;

- to authorize the buy-back of securities under section 68;

- to issue securities, including debentures, whether in or outside India;

- to borrow money;

- to invest the funds of the company;

- to grant loans or give guarantee or provide security in respect of loans;

- to approve financial statement and the Board’s report;

- to diversify the business of the company;

- to approve amalgamation, merger, or reconstruction;

- to take over a company or acquire a controlling or substantial stake in another company;

- any other matter which may be prescribed:

The Board of Directors can officially choose to delegate specific powers to various individuals or groups within the company, such as committees, managers, or officers, including those at branch offices. They can also establish conditions under which these powers are to be exercised.

Further, it says that when a bank accepts deposits from the public or deposits money with other banks, these actions are regarded as standard business operations. They are not categorized as borrowing funds or granting loans under this section of the law.

EXPLANATION 1: – The provision of section 179(3)(d) that is power to borrow the money will not apply in the case of borrowing by the banking company from other banking companies or the Reserve Bank of India and State Bank of India or any other bank

EXPLANATION 2: – When a company arranges with its bank to borrow money, such as establishing an overdraft or cash credit facility, it is exercising its borrowing power. This is distinct from the routine transactions using those accounts, which merely involve utilizing the prearranged agreement.

SECTION 179(4): – This section says that this section shall not affect the right of the company to make provisions related to restrictions of these rights in the general meeting. This means that these rights are not absolute. There are some restrictions as well.

RELATION BETWEEN SECTION 179(3) AND SECTION 186(5)

At first glance, it seems that the proviso to Section 179(3) of the Act outlines the powers of the board that can be delegated to a committee of directors, the managing director, the manager, or any other principal officer or branch officer of the company, particularly concerning borrowing funds, granting loans, and making investments. However, Section 186(5) of the Act imposes restrictions on the powers granted under Section 179(3) by requiring unanimous consent during board meetings for approving loans, guarantees, securities, and investments. These inconsistencies emphasize the need to understand the details of both sections when delegating powers within a company. Therefore, the scope and nature of delegated powers must be carefully assessed and customized to meet the company’s specific needs and conditions. It is essential to give effect to both provisions of the Act.

CONCLUSION

The Companies Act, 2013, particularly Section 179, is crucial in outlining the powers and responsibilities of a company’s Board of Directors. This section authorizes the board to make significant decisions such as borrowing funds, investing company resources, and approving mergers and acquisitions. Additionally, it permits the board to delegate certain powers to committees, managing directors, or principal officers, thus ensuring operational flexibility.

However, this delegation of authority comes with important checks. Section 186(5) imposes a vital safeguard by requiring unanimous board consent for major financial decisions, including loans, guarantees, and investments. This ensures that while the board can act decisively, substantial financial commitments receive collective approval, thereby preventing unilateral actions that could compromise the company’s financial stability.

Furthermore, the act distinguishes between establishing borrowing arrangements and their routine use. Setting up an overdraft or cash credit facility is seen as an exercise of the board’s borrowing power, while daily transactions within these facilities are considered regular business operations.

This dual-layered approach in the Companies Act provides a balanced governance framework. It grants the board the necessary authority to manage and direct company affairs while embedding essential safeguards to maintain accountability and prevent power misuse. Companies must understand these provisions thoroughly to tailor the delegation of powers effectively, aligning them with their specific operational needs and strategic goals.

In summary, Sections 179 and 186 of the Companies Act, 2013, offer a comprehensive framework for corporate governance. By balancing managerial discretion with necessary oversight, these sections ensure that the delegation of powers is prudent and that major financial decisions are made with the entire board’s consensus.

Author: Devyani Pranav, in case of any queries please contact/write back to us via email to chhavi@khuranaandkhurana.com or at Khurana & Khurana, Advocates and IP Attorney.

References

[1] The Companies Act, 2013 (Act 18 of 2013)

[2] The Companies Act, 2013 (Act 18 of 2013), s. 2(10)

[3] The Companies Act, 2013 (Act 18 of 2013), s. 73(1)

[4] The Companies Act, 2013 (Act 18 of 2013), s. 135(1)

[5] The Companies Act, 2013 (Act 18 of 2013), s. 178(3)