INTRODUCTION

Corporate governance is how a corporation’s values, guiding principles, and management practices are ingrained and manifested. Corporations, governments, investors, and others now acknowledge that diversity on company boards is critical to successful corporate governance. “Diversity in boardrooms” is a hotly contested issue in the field of corporate governance nowadays.

Economic growth depends on empowering women to hold leading roles on boards. Gender diversity on boards should be prioritized for two reasons: The first has to do with human rights and social justice. Organizations and their boards function in an environment where societal biases are ingrained in business. Similar to the majority of other nations, women in Indian society have historically been viewed as secondary to men and have usually held inferior position. This bias is reflected in the underrepresentation of women on corporate boards.

Establishing a strong foundation for sound corporate governance is crucial, given the rapid growth of the Indian economy. Companies can implement “efficient risk management procedures” which will lead to an increase in trust by public and investors. Simultaneously, it will provide the company with a direction. As of 2018, in the Catalsyt report, a company having diversity in board is less prone to fraud, contentious decisions and therefore have greater CSR scores[1].

Apart from women’s right to be on the board, another concern that arises is businesses and society at large who are losing out on when they fail to utilize women’s potential. To address complex corporate difficulties, boardrooms require a wide diversity of “perspectives, talents, personalities, and viewpoints.” It has been recognised that when a company brings together men and women from different backgrounds on the same platform and allow the, to share their thoughts, experiences, and abilities brings out the best possible answers to problematic situations.

LEGAL PROVISON

The Board’s main responsibility to the shareholders is to create, preserve, and grow their wealth; to maximize the use and conservation of the company’s resources; and to transparently report on the company’s activities to them regularly. Accordingly, to ensure the same, the provisions of Companies Act, 2013 by way of section 149(1)[2] mandate every public company be it listed or unlisted, and has paid up share capital of Rs. One hundred crore or the turnover for the same is Rs. Three hundred crore or more according to the latest audited financial statements, to have at least one- women director in the boardroom. There is a discretion as to the women director being an executive one or non -executive.

In addition to the above guidelines, an amendment was brought in, in the SEBI (LODR) Regulations 17, 2015[3]. They were made in response to recommendations proposed by Kotak’s Committee on Corporate Governance. Came into effect on April 1, 2019, the provision stated that top 500 listed companies (on the basis of market capitalization) shall have “at least one women director” in the boardroom by 1.04.2019. Similarly top 1000 listed companies had to comply with the same guidelines by 1.04.2020. The word “shall” indicate an obligatory duty on the part of companies to appoint at least one women director but the compliance and position as of now is far from reality.

CASE STUDY

The situation of women in boardroom is substantiated with the help of an established entity, ICICI Bank Ltd., an Indian multinational bank which provide financial services.

Out of total 114 women directors present in all funding institutions, ICICI Bank’s share was 56 women directors. Apart from these financially supported roles with private enterprises, from 1995 to 2007, ICICI Bank has 24 females in boardroom. Additionally, 23 board posts at HDFC and HDFC Bank were given to women. Upon calculating the entire ICICI contribution, it could be interpreted that ICICI was responsible for 80 “women directorships” or “13% of all women directorships” between 1995 and 2007. Apart from that, they also occupied various directorships in private companies so as to look after interests of bank[4].

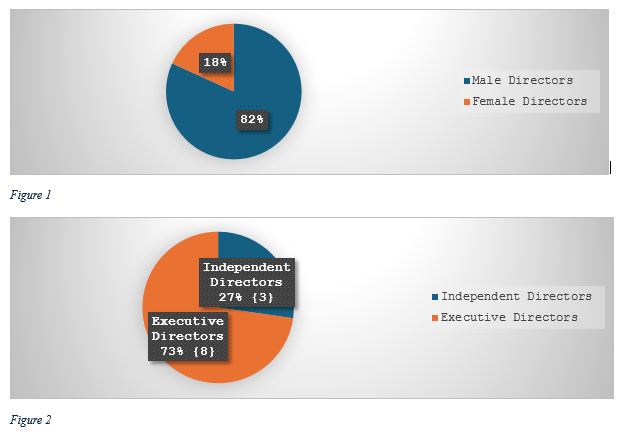

As of June 30, 2023, this financial institution had a total of 11 directors, out of which two were female and the rest nine were male directors {Figure 1}. The bank has ensured that they have high corporate standards and therefore they have ensured compliance of the SEBI Guidelines, 2015 as well as Companies Act, 2013 for board composition. ICICI Bank’s core principle states that “At ICICI Bank, we are committed to adhering to the high standards of governance in the way we conduct our business. We ensure compliance with the laws, rules and regulations that govern our business and have established a culture of accountability, transparency, and ethical conduct.”[5]

While they have 8 independent directors, the other 3 are executive directors {Figure 2}. Another important fact to be noted is that the two women directors on the board, Vibha Paul Rishi and Neelam Dhawan, both of them belong to the pool of Independent Directors. Independent directors[6] are neither employee of company, neither are they granted ESOPs. While the author appreciates the fact that the board of ICICI contains women directors, the author also strongly feels that the executive board should also have female directors. Independent directors no doubt play a very crucial role in the corporate governance of the entity. They are like an oversight body who monitor company’s performance and surroundings and acts as a watchdog and raises red flags whenever they smell suspicion. Executive director, on the other hand are bestowed with “executive responsibility” and run the business of company. They are actively involved in core decision making and operational matters. In such situation, the author feels that women of today are very much capable of doing the same.

CRITICAL ANALYSIS

WHY WOMEN ON BOARD[7]?

- Prudence: A woman’s presence on a board can alter its dynamics simply because of the inherent attributes that women possess. She is more cautious, patient, and detail-oriented. Usually, she has better skills in interacting.

- Focused: Despite having a distinct outlook and manner of acting, a woman manages to stay more comprehensive, think globally, and be more mindful of social and environmental issues.

- Approachable: they have inquisitive nature which makes it easy to ask questions from them. Her presence results in improved procedures and policies for “cross-checks, double-checks, second opinions, and consultations”, leading to perfection because she is less risk averse.

- Better Judgement: Regarding oversight and scrutiny, women tend to be more cautious and diligent. She is more qualified to judge CSR, advertising, PR, consumer products marketing strategies, HR policies, and, increasingly, compliance-related matters.

- Co-ordination: Because she is more inclusive, she can raise concerns about how company activities affect the company’s workers, clients, and other stakeholders, as well as the environment and the general public. Men view themselves as more independent, concentrating more on the strategy of the company and performance, whereas women regard themselves as more attuned to interactions with different stakeholders.

- Empowerment: An educated and highly experienced women director is perceived as someone who would advocate for cultural change and is surely a role model for other stake holders. Her presence gives other women the confidence to take on challenges and advance in their chosen fields. She can develop upcoming directors from the inside.

ROADBLOCKS IN IMPLEMENTATION[8]:

- Leaking Pipeline: Women executives are unable to progress due to the sociocultural norm that exists in India. Although many bright women have great dreams and aspirations when they first enter the industry, as they advance in their careers, their goals become less clear due to shifting priorities about family and other obligations. This is the primary cause of the shortage of talented women.

- Restricted bandwidth: Though women may qualify for Board positions, owing to family commitments they may be reluctant for taking it up. In addition to this certain unhelpful attitudes and stereotyping makes it difficult for women to find the required time to pursue Board positions.

- Limited understanding of the advantages of board membership: Women typically fail to recognize the advantages of serving on the board, such as the opportunity to learn from accomplished professionals, the development of analytical abilities, and the art of influencing others.

- Liabilities and hazards associated with becoming a board member: Most women hesitate to apply for board membership because of several legal implications involved. They often face the dilemma and question themselves, “Is it worth being on a board?” because of the risks that come with it.

- Non compliance by companies due to lack to fear: Looking at the data of past five years it is evident that even after a decade of introduction of these mandatory rules, the companies listed on Bombay stock exchange have failed to comply with the same. Not only that, they readily accept the fine imposed on them. This poses certain questions about company’s situation. Do they not see women as leaders? Or is there a lack of competent women who can take up the position of director? Women of today have excelled in every possible sector and there are more to come. They need more acceptance from their male counterparts.

The CEO and President of Pax World Funds, Joe Keefe was right when he said “When women are at the table, the discussion is richer, the decision-making process is better, management is more innovative and collaborative, and the organization is stronger. Because companies that advance and empower women are, in our view, better long-term investments, we are encouraging companies in our portfolios to enhance their performance on gender issues.[9]” The same is evident from success of HDFC bank and ICICI bank.

CONCLUSION AND WAY FORWARD

In the Indian corporate scenario, section 149 (1) of the Companies Act can be considered as first step aiming towards achievement of gender equality in the boardroom. However, given how things are changing and corporations’ persistent non-compliance, it is imperative to reevaluate the effectiveness of the provisions. The position is still far from reality. The proportion of women appointed must be raised. The proportion of women appointed must be raised. Legislation, regulations, and orders only fulfil their intended purpose when individuals themselves inculcate the feeling that a change is required. Need of the hour is to let women do things which they as a matter of right can do.

In order to bridge the gap between legislation and practical implementation a few suggestions have been prevented:

- Rules need enforcement with strict supervision. Big companies have a very casual approach towards this provision. Companies with large amount of money escape liability by paying without even bothering that they have a mandate to comply with. A different form of penalty is required to deal with such delinquents.

- Whereas the provision mandates for only one women director, many companies just appoint one women director and get done away with it. They fail to recognise the richness which women bring in decision making process. Furthermore, this number needs a revision according to the “proportion or fraction of the board.”

- Looking at the snail like speed development of India when it comes to women empowerment, with consistent efforts, right education, awareness and conscious citizens, the day will come when India will be at par with international countries in terms of women representation in the boardroom.

Author: Anavi Jain and Sonakshi Pandey, in case of any queries please contact/write back to us via email to chhavi@khuranaandkhurana.com or at Khurana & Khurana, Advocates and IP Attorney.

[1] “WOMEN ON BOARDS IN INDIA- NUMBER, COMPOSITION, EXPERIENCES AND INCLUSION OF WOMEN DIRECTORS, research report by Indian Institute of Management Ahmedabad, http://www.primeinfobase.com/indianboards/files/IIM_Ahmedabad_FICCI_PRIME_WOB_report.pdf

[2] The Companies Act, 2013, S149 (1), No. 18, Acts of Parliament, 2013 (India).

[3] Securities and Exchange Board of India (Listing Obligation and Disclosure Requirements) Regulations, 2015, Regulation 17.

[4] S Chandrashekar, Women power in corporate India: women directorships on Indian Corporate boards 1995-2007 trends (2010).

[5] Board Composition and Expertise of the Board, ICICI Bank, https://www.icicibank.com/ms/aboutus/annual-reports/2022-23/icici-esg/corporate-governance.html#:~:text=Board%20of%20Directors%20and%20Expertise%20of%20the%20Board,-ICICI%20Bank%20has&text=The%20Board%20consists%20of%20distinguished,and%20three%20were%20Executive%20Directors.

[6] Manu Sharma, Role of Independent Directors in Corporate Governance, 16 SUPREMO AMICUS 198 (2020).

[7] Akash Chatterjee & Moulinath Moitra, A Research on the Dearth of Women Directors on Corporate Boards, 5 INDIAN J.L. & LEGAL RSCH. 1 (2023).

[8] Supach Rishi, Women Director: Corporate Governance and Gender Diversity in India, A Critical Analysis (2022).

[9] Id.