Laws governing the duties and rights of India’s working class are referred to as “labour laws” in India. Every worker and employee has certain rights, and the Constitution of India under articles “14-16, 19(1)(c), 23-24, 38, and 41-43A” specifically address labour laws in India in order to safeguard their interests and rights. In India, there are presently 44 laws that control labour, employment and working conditions excluding the regulations laid down by the State. In accordance with the Constitution, both the Center and the State may enact regulations and legislation regarding labour.

Recently, the central government has taken a great step to nationalize 29 of these laws into four codes –

- “The Code on Wages, 2019”

- “The Industrial Relations Code, 2020”

- “The Code on Social Security, 2020”

- “The Occupational Safety, Health, and Working Conditions Code, 2020”

Overtime Payment Legislations in India

There are many rules in India that set limits on the number of hours of overtime that are permitted as well as a method for calculating those hours. Many sectors are currently unable to use the overtime legislation for paid workers. The situation could improve in the upcoming days when new labour laws are put into effect in India.

The overtime laws also stipulate that there must be at least one 30-minute break between working hours for the employees and that the total daily working time must be calculated such that no one working hour surpasses five hours without a break.

According to Indian overtime payment regulations, overtime compensation can be received in factories either as a per-piece rate or as an hourly rate.

- In the per hour or hourly rate, the employee’s hourly compensation is calculated, and for each additional hour worked, double the amount is paid.

- The per-piece technique pays overtime for each additional piece produced during the overtime period.

What are the normal working hours & overtime?

- An employee has worked overtime when their total number of scheduled hours has been exceeded. Employees in India are required to work 8 to 9 hours per day, or 48 to 50 hours per week, in accordance with the overtime rules and policies that define work hours.

- According to Indian employment law, every employee who works longer than the required working hours is entitled to overtime pay for the time spent beyond those hours.

Applicability of Overtime Payment Legislations

Eligibility Criteria

- A person working in any factory

- A person working in mines (underground or above ground)

- A person working as a journalist

- A person working as a Building or construction workers

- Any person working in a scheduled employment

- Any person working in a shop or establishment

- A Contractual labour

Person who are not Eligible for overtime Payment

- Any member of the armed forces

- Any person working beyond the overtime work limits

- Any person working overtime without authority

Formula for Calculating Overtime Payment

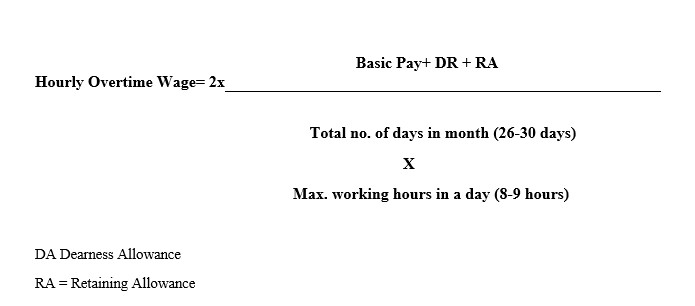

The regulations governing overtime payment guidelines that are referenced in various statutes make it clear that the type of work and location (State or Union territory) play a significant effect in how much overtime is paid. The following overtime computation formula in India may be used on average and for those industries covered by the central laws:

Is overtime calculated on basic or gross salary?

According to Indian overtime payment regulations, it is based on basic wage. Additionally, any other allowance or dearness may be included. However, it should be noted that any bonus or other form of incentive is disregarded for determining or calculating India’s overtime payment regulations. In any event, the rules regarding overtime payment take no account of the total wage. However, Indian overtime payment laws do not prohibit employers from rewarding devoted workers voluntarily in the absence of a legal need. In such a situation, it is up to the employer to decide whether overtime is paid in India on a basic or gross basis.

The provisions regarding overtime payment vary from legislations to legislations. This has been explained below.

The Code on Wages, 2019

The Code on Wages, 2019 (hereinafter the “Code”), not implemented as of yet, incorporates the provisions of the following laws and intends to revise and streamline the laws governing wages, bonus, and matters related to or incidental to those laws.

- “Payment of Wages Act, 1936.”

- “Minimum Wages Act, 1948.”

- “Payment of Bonus Act, 1965.”

- “Equal Remuneration Act, 1976.”

All employees shall be subject to the Code. The central government will decide on pay for jobs in industries like railroads, mining, and oil fields, among others. All other employment-related decisions will be made by state governments. Salaries, allowances, and other components that are expressed in money are all considered to be wages. This excludes, among other things, any travel expenses or employee bonuses.

The length of a typical workday may be set by the central or state governments. Employees who work longer than the typical workday are entitled to overtime pay, which must be at least double the regular rate of pay.

Numerous workplaces in India are covered by the overtime provisions of the labour code. These laws specify whether it is up to the central or state governments to determine the applicable overtime payment requirements. The fact that the overtime regulations in one state might not be the same as the overtime payment rules in any other state.

Shop/ Establishment: Shops and Establishments Act of States/ UTs

In India, each state has its own Shops and Establishment Act (SEA), which also establishes guidelines for employees of various organisations that work overtime. Every managerial and non-managerial position in every Indian shop and establishment is subject to the SEA.

Apart from the scheduled working hours at the businesses or establishments, employees are paid for overtime hours at a rate set by the states or union territories. The duration of overtime is double the regular working hours in several states. Once more, the basic pay plus allowances are used to establish the employee overtime rate (not including any bonus). The ingredients that must be present in order to be satisfied are as follows.

- Daily working hours may range from 8-10 hours

- Weekly working hours cannot exceed 48 hours

- Overtime may range from 10-11 hours on a daily basis (1 to 3 hours)

- No continuous (break-free) work for more than 5 hours in one go

- Weekly limit of 50-60 hours

- Quarterly limit of 50-150 hours

- Spreadover limit of 10-14 hours

Factories Act, 1948

If a person is compelled to work more than 9 hours per day or more than 48 hours per week, they are entitled to double their regular rate of pay under Section 59 of the Factories Act, 1948. Without any bonus or other overtime pay, the wages mentioned here are equivalent to the basic rate plus allowances. If a worker receives payment on a “piece rate” basis, the time rate will be determined using the previous month’s data, and the amount of overtime pay will be determined appropriately.

Minimum Wages Act, 1948

According to Section 14 of the Act, any worker whose minimum rate of pay is determined with a wage the period of time, such as by the hour, by the day, or by any such period, is regarded to have worked overtime if they put in more time than that. If the number of hours that make up a typical workday is greater than the allotted amount, the employer is required to pay the employee at the overtime rate for each hour or portion of an hour that was worked in excess.

According to Section 33, workers who work overtime must be paid at a rate that is double their regular rates of pay. It states that the employer may accept actual work up to a maximum of 9 hours every 12-hour shift on any given day. For any hour or portion of an hour of actual work that exceeds nine hours or more than 48 hours in any week, he must pay double the rates.

Bidi and Cigar Workers (Conditions of Employment) Act, 1966

According to Sections 17 and 18 of the Act, which deal with working hours, the total amount of time spent working, including overtime, should not exceed 10 hours per day and 54 hours per week.

Contract Labour (Regulation & Abolition) Act, 1970

Every contractor is required by Rule 79 of the Act to keep a Register of Overtime in Form XXIII, which must include all information pertaining to overtime computation, hours of additional labour, employee name, etc.

Factors to be kept in mind while determining Policy for Overtime Payment

- The reporting time and working hours for each employee, as well as any provisions for leaves of absence and holidays, must be made explicit in the company’s overtime policy. The company’s policy regarding any compensation for overtime labour performed by any employee must also be included in the HR policy.

- The employee must willingly accept the overtime labour rather than having it imposed on them through an unconscionably or fraudulently signed contract.

- Before granting an employee overtime, the employer must take certain aspects into account, such as any unexpected or abrupt increase in work or demand, or if the employee willingly requests the extra time in order to boost productivity.

- To do this, the employer must have a policy in place outlining the circumstances under which overtime can be allowed.

- Every employer is expected to keep an attendance record for overtime that lists the specifics of the employees who work over regular business hours and the amount of compensation that will, if any, be provided.

Conclusion

In India, the most of the working sector is unaware of employee rights and the regulations governing overtime work. For the purpose of calculating overtime in India, it is crucial for an employer to have their employment contract and Company’s overtime policy drafted.

Author: Simran Dhaner, Coauthor: Meenakshi Ogra Mukherjee, in case of any queries please contact/write back to us via email chhavi@khuranaandkhurana.com or at Khurana & Khurana, Advocates and IP Attorney.