- AI

- Air Pollution

- Arbitration

- Asia

- Automobile

- Bangladesh

- Banking

- Biodiversity

- Biological Inventions

- bLAWgathon

- Brand Valuation

- Business

- Celebrity Rights

- Company Act

- Company Law

- Competition Law

- Constitutional Law

- Consumer Law

- Consumer Protection Authority

- Copyright

- Copyright Infringement

- Copyright Litigation

- Corporate Law

- Counterfeiting

- Covid

- Cybersquatting

- Design

- Digital Media

- Digital Right Management

- Dispute

- Educational Conferences/ Seminar

- Environment Law Practice

- ESIC Act

- EX-Parte

- Farmer Right

- Fashion Law

- FDI

- FERs

- Foreign filing license

- Foreign Law

- Gaming Industry

- GDPR

- Geographical Indication (GI)

- GIg Economy

- Hi Tech Patent Commercialisation

- Hi Tech Patent Litigation

- IBC

- India

- Indonesia

- Intellectual Property

- Intellectual Property Protection

- IP Commercialization

- IP Licensing

- IP Litigation

- IP Practice in India

- IPAB

- IPAB Decisions

- IT Act

- IVF technique

- Judiciary

- Khadi Industries

- labour Law

- Legal Case

- Legal Issues

- Lex Causae

- Licensing

- Live-in relationships

- Lok Sabha Bill

- Marriage Act

- Maternity Benefit Act

- Media & Entertainment Law

- Mediation Act

- Member of Parliament

- Mergers & Acquisition

- Myanmar

- NCLT

- NEPAL

- News & Updates

- Non-Disclosure Agreement

- Online Gaming

- Patent Act

- Patent Commercialisation

- Patent Fess

- Patent Filing

- patent infringement

- Patent Licensing

- Patent Litigation

- Patent Marketing

- Patent Opposition

- Patent Rule Amendment

- Patents

- Personality rights

- pharma

- Pharma- biotech- Patent Commercialisation

- Pharma/Biotech Patent Litigations

- Pollution

- Posh Act

- Protection of SMEs

- RERA

- Sarfaesi Act

- Section 3(D)

- Signapore

- Social Media

- Sports Law

- Stamp Duty

- Stock Exchange

- Surrogacy in India

- TAX

- Technology

- Telecom Law

- Telecommunications

- Thailand

- Trademark

- Trademark Infringement

- Trademark Litigation

- Trademark Registration in Foreign

- Traditional Knowledge

- UAE

- Uncategorized

- USPTO

- Vietnam

- WIPO

- Women Empower

Prefatory

The year 1991 has been a game-changer for India; however, nothing has remained the same ever since. The introduction of ‘E-commerce’ in India not only changed the way how people buy products but also contrived a critical situation for brick and mortar stores that follow the traditional routine of buying and selling. According to the projections of IBEF (India Brand Equity Foundation), the Indian E-commerce industry is set to reach the US $99 billion by 2024 but at the same time, the survival strategy of any small retailer/Kirana store is to shake hands with the big players of the E-commerce market. Moreover, it is not uncommon how e-retail giants like Amazon have been flouting rules and twisting their practices in order to make maximum profits. The retail sector in India is unorganized which makes it important for the Government to prioritize them while framing a feasible E-commerce policy.

Inventory Based or Market Based?

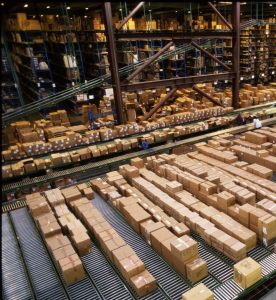

A Marketplace model of E-commerce is where an IT platform is provided in the form of a market that facilitates various buyers and sellers to connect and conduct trade.

[Image Source: gettyimages]

The revised FDI guidelines (2020) on multi-brand retailing have placed a clear distinction that any entity that provides a marketplace shall not have control and ownership in the inventory, which is the goods stock to be sold. The embargo has been placed over the marketplace entities that if any of their group companies are selling more than 25% of what the vendor is selling on the marketplace, it will fail to qualify as a marketplace and will be seen as an inventory-driven FDI marketplace where FDI is prohibited. According to these regulations, an entity can take up only 25% of the total purchases from its subsidiaries, if they wish to continue their business through the marketplace-based model of e-commerce. Marketplace-based model of e-commerce has the liberty of 100% FDI through automatic route whereas inventory-based model has none, the basic idea of the said regulation is to keep marketplace a sales-driven platform where there is an opportunity for different players to carry out business. The said rule is furthered by a restriction brought about by the new regulations that the marketplace entity or any of the group companies of the marketplace entity cannot own a single percentage of equity in any company which is a vendor on the marketplace. This means that an entity providing marketplace shall not have a stake in the vendor company as well, which extinguishes indirect ownership in the transactions on the marketplace. If the marketplace entity does not take up more than 25% of business on the marketplace but has equity in the vendor companies then it defeats the purpose and hence such exercise is not allowed.

It can be easily construed from the above guidelines that the same have been introduced to keep the small players in the game and to safeguard them from the exploiting tactics of giants like Amazon. Amazon is undoubtedly the largest online trading company in the world. It highlights 400,000 plus Indian sellers on its online platform but the fact is that only 33 Amazon sellers account for about a third of the overall sales conducted on the company’s online platform. Amazon owns a minority stake in the parent companies of ‘Cloudtail’ and ‘Appario’ where it does not have a direct stake in either of the two sellers which account for the majority of the sales carried on its platform. According to the Forrester research, in 2019, Cloudtail accounted for 40% of the overall $10 billion sales clocked by Amazon in India. ‘Cloudtail India’ is essentially owned by Prione Business Services, which is a joint venture between Amazon India and NR Narayana Murthy’s Catamaran Ventures. On the other hand, Appario Retail is a company owned by Frontizo, which is a joint venture between Amazon India and Patni Group. Amazon time and again has been adjusting its ownership and holdings in the said ventures in order to conduct E-retailing in India under the Marketplace model.

CCI’s Step in

The Competition Commission of India (CCI) is a statutory body established to promote fair competition in the market and prevent anti-competitive practices and such activities that have an appreciable adverse effect on the competition in the market. The CCI has, time and again, received complaints of Amazon and Flipkart for anti-competitive practices from various stakeholders in the Indian market. These e-retail giants arguably have a dominant position in their respective markets. This enables them to enter into agreements with specific sellers that can oust various other sellers from the market, provide deep discounts to selected sellers, give preferential listings on the website, and create barriers for new entrants in the market.

Recently, the Competition Commission of India has received a complaint against Amazon India, filed by the representative of a group of small online sellers called ‘Aiova’. It has been alleged that Amazon has been giving preferential treatment to selected sellers like Cloudtail where it holds equity. This comes at the time when Amazon is already facing a suit of similar nature before the Karnataka High Court. Not only this, but regulators like the Reserve Bank of India and Enforcement Directorate are also investigating allegations of FDI violations by Amazon and Flipkart.

Way Forward

Even though the magical numbers of the E-commerce industry in India are skyrocketing, the fact remains that the online retail market constitutes only 3% of the total retail market. The kind of model that Amazon adapts to run its business is suitable for an economy with an organized retail sector and not a country like India where the maximum retailing is done through small or Kirana Shops. In 2020, Amazon announced a pilot project named ‘Kirana Now’ which is an express delivery platform with its tie-up with the traditional brick and mortar shops in India. The said project is launched to cater to the need of the local market and also digitalize the business of such small shops. But the concern that arises here finds its genesis in Amazon’s behavior in the past recent years. The initiation of relationship building with the Kirana stores may or may not be pure business but one cannot be relieved that Amazon will not repeat its foul strategies to control the market again.

The Government, on the other hand, has been constantly reviewing and changing its policies in an attempt to build a strong and stringent E-commerce Policy that provides a fair market to the e-retailing giants and helps strengthen the traditional retail sector as well. The question, “How will the small players survive in competition with the E-commerce giants in the retail sector?” has constantly pushed the government to amend policies. Even after constantly changing rules, there has been non-compliance with respect to the same and the Confederation of All India Traders (CAIT) has repeatedly shown its concern over e-retailers violating FDI rules. The concern is over entities providing E-commerce platforms still holding a stake in the seller indirectly. In wake of this, the Department of Promotion of Industry and Internal Trade (DPIIT) may release even stringent guidelines in order to curb such practices. The government is also considering prohibiting online sales by a seller who, for example, purchases goods from an e-commerce entity’s wholesale unit, or any of its group firms, and then sell them on the entity’s websites. This move may limit the E-commerce giants to leverage their scale in India, but what can one do when the question is of fair competition and equal treatment.

Author: Gaurav Sharma, a Final Year student of Symbiosis Law School (Pune), an intern at Khurana & Khurana, Advocates and IP Attorneys. In case of any queries please contact/write back to us at aishani@khuranaandkhurana.com.