- AI

- Air Pollution

- Arbitration

- Asia

- Automobile

- Bangladesh

- Banking

- Biodiversity

- Biological Inventions

- bLAWgathon

- Brand Valuation

- Business

- Celebrity Rights

- Company Act

- Company Law

- Competition Law

- Constitutional Law

- Consumer Law

- Consumer Protection Authority

- Copyright

- Copyright Infringement

- Copyright Litigation

- Corporate Law

- Counterfeiting

- Covid

- Cybersquatting

- Design

- Digital Media

- Digital Right Management

- Dispute

- Educational Conferences/ Seminar

- Environment Law Practice

- ESIC Act

- EX-Parte

- Farmer Right

- Fashion Law

- FDI

- FERs

- Foreign filing license

- Foreign Law

- Gaming Industry

- GDPR

- Geographical Indication (GI)

- GIg Economy

- Hi Tech Patent Commercialisation

- Hi Tech Patent Litigation

- IBC

- India

- Indian Contract Act

- Indonesia

- Intellectual Property

- Intellectual Property Protection

- IP Commercialization

- IP Licensing

- IP Litigation

- IP Practice in India

- IPAB

- IPAB Decisions

- IT Act

- IVF technique

- Judiciary

- Khadi Industries

- labour Law

- Legal Case

- Legal Issues

- Lex Causae

- Licensing

- Live-in relationships

- Lok Sabha Bill

- Marriage Act

- Maternity Benefit Act

- Media & Entertainment Law

- Mediation Act

- Member of Parliament

- Mergers & Acquisition

- Myanmar

- NCLT

- NEPAL

- News & Updates

- Non-Disclosure Agreement

- Online Gaming

- Patent Act

- Patent Commercialisation

- Patent Fess

- Patent Filing

- patent infringement

- Patent Licensing

- Patent Litigation

- Patent Marketing

- Patent Opposition

- Patent Rule Amendment

- Patents

- Personality rights

- pharma

- Pharma- biotech- Patent Commercialisation

- Pharma/Biotech Patent Litigations

- Pollution

- Posh Act

- Protection of SMEs

- RERA

- Sarfaesi Act

- Section 3(D)

- Signapore

- Social Media

- Sports Law

- Stamp Duty

- Stock Exchange

- Surrogacy in India

- TAX

- Technology

- Telecom Law

- Telecommunications

- Thailand

- Trademark

- Trademark Infringement

- Trademark Litigation

- Trademark Registration in Foreign

- Traditional Knowledge

- UAE

- Uncategorized

- USPTO

- Vietnam

- WIPO

- Women Empower

Introduction

On 25th March tech giant, Apple made its groundbreaking entry in the arena of digitalized financial services. Apple in partnership with Goldman Sachs Group Inc. and MasterCard has broadened its product line with the new “Apple Digital Credit Card” payment system. This credit card takes advantage of everything that Apple products offer to set a new kind of credit-based service via its Wallet App by setting up Apple Pay feature, which allows users to maintain a digital account balance and spend it for making store purchases, online payment as well as Peer-to-Peer lending through digital wallet system, scanning QR codes, etc. This card network will benefit every sector where Apple Pay is accepted and will allow users to track their privacy.

Existing Payment Structure in Indi

The IT sector in India has taken several measures to develop and promote the payment system in the country. Various initiatives have been taken by the government as well as private players. As a part of this development the “Digital India” campaign by Ministry of Electronics & Information Technology has empowered the Indian economy to go ‘Faceless, Paperless, and Cashless’. The campaign have given nascence to various types of digital cashless payment system such as digital debit/credit cards, UPI services, mobile wallet system, USSD, mobile banking, Bank prepaid cards etc. Some of these existing digital payment systems in India are:

(1) Banking Cards: These cards are issued to customers on their linked bank account number and provides security, convenience, and control than most of the other payment systems. These cards provide credit, debit and prepaid services. These are the most secured way of making transaction owing to 2 factor authentication system i.e. secure PIN (Personal Identification Number) and OTP (One Time Password) on the registered mobile. Although these are tangible cards, but can be linked to other apps for making digital payments and online transactions for merchant websites by getting it authenticated.

(2) Unstructured Supplementary Service Data (USSD): It is an innovative payment service which can be used to make transactions even in the most basic mobile phones without having any internet data facility. The service can be availed by dialing *99# as “Common number across all Telecom Service Providers (TSPs)”. The service includes interbank account to account fund transfer, balance enquiry, mini statement besides host of other services.

(3) Aadhaar Enabled Payment System: This payment system allows online interoperable financial transactions at Point of Sale (PoS) through the Business Correspondent /Bank Mitra of any bank using the Aadhaar authentication. The system works by linking your Aadhaar card to your bank account. The system allows secure transactions by getting it authenticated by fingerprint with the bank Unique Identification Authority of India (UIDAI) system. Once the authentication is over, the customers can perform some of the basic bank functions like balance enquiry, cash withdrawal, cash deposit, remittances etc. with the use of Aadhaar card.

(4) UPI Services: It is a type of interoperable instant real-time payment system that is linked to the customer’s bank account and allows sending and receiving money. Developed by National Payment Corporation of India (NPCI) and regulated by RBI, the interface allows transferring of funds between two bank accounts on the mobile-based UPI App. Almost all digital payments apps in India are linked via UPI based service. Some of these are Paytm, BHIM APP, Mobikwik, PhonePe, Jio Money, Amazon Pay, Google Tez, Citrus Wallet, Citi Master Pass etc.

(5) Mobile Wallets: These are virtual wallets /e- wallets available on the mobile phone and can be accessed by downloading the payment app. These e-wallets are nothing but an intangible form of the physical debit/credit card in hand. The e-wallet or mobile wallet can be easily accessed by keying in some basic personal information and payment details of debit/ credit card information and the user can simply make the payment with the help of such app. Some of the commonly used mobile wallet apps in the market are M-PESA by Vodafone and ICICI Bank, Flipkart’s e-wallet and Amazon Pay, Paytm, Mobiwik etc.

(6) Bank Pre-Paid Cards: A prepaid card is an alternative banking card that only lets the consumer to spend preloaded money online. The payment network can be used anywhere that accepts prepaid cards, such as Mastercard or Visa. Unlike debit cards these cards are not linked to the bank account, and allow spending only preloaded amount.

(7) Internet Banking: It is an electronic payment system that enables customers to carry out varied forms of financial transitions across different search engines.

(8) Mobile Banking: It is a service provided by banks that allows financial transactions remotely using mobile devices. It uses software, usually called an app, provided by the banks or financial institution for the purpose. Each Bank provides its own mobile banking App for Android, Windows and iOS mobile platform(s).

Some of the most commonly used apps that provide virtual financial transitions are:

(1) PayTM, Mobikwik, Freecharge: These are mobile payment platform applications that allow the customer to load money from registered bank account to the respective app and make payment to merchants who have operational tie-up with that app.

(2) Amazon Pay: It is owned by Amazon and allows customers to make payments with external merchants’ websites and apps that accept Amazon Pay. Similar analogous features are also provided by eBay, Flipkart, Snapdeal, etc.

(3) Google Pay/ BHIM: These are UPI based payment system that allows money transfer directly through the bank account via the app.

(4) Yono by SBI, Citi MasterPass, ICICI Pockets, HDFC PayZapp etc.: These payment systems are linked to the respective bank accounts and can be used to make payments across different platforms.

Revolutionary Change: How the Apple Credit Card is Different from Other Payment Methods

The “Apple Credit Card” may prove as a threat to other physical credit cards and overall virtual transaction applications issued by financial institutions by simplifying access to credit facility and avoiding monotonous application procedures with banks. Further, this may also change the payment eco-system of traditional and dominant well recognized global card networks like Visa and Master Cards in the Indian Digital Market. E-commerce and Smartphone penetration are two of the biggest drivers for Fintech companies for making virtual transactions. This will increase the consumer base of Apple products and introduce more ways to pay that will drive out the replacement of cash credits with electronic payments.

This service may be a potential threat to Fintech companies such as like Wealthfront, SoFi, Chime, Robinhood etc. and Indian payment apps such as PayTM, MobiKwik, PhonePe etc., and other financial institutions that may affect as an alternative vocal payment system by bypassing the traditional methods of payment card scheme that lay in emerging markets with underdeveloped banking systems.

Fintech industries that generally invest with the small financial institutions may face a crisis from such high amount of investments made by Goldman and MasterCard to maintain their current operating mode.

Basic Features and Advantages of Apple Credit Card

The most important perk of this card is that there will be no annual fee, foreign-transaction fees and late fees charges as opposed to other cards available in the market. The card will be based on the revolutionary technology as users will be able to make the payment just by authenticating the transaction through TouchID or FaceID without having a signature, card number or CVC i.e. physical card in hand. As compared to other virtual credit cards, this card will have a major impact in the Indian market. Benefits offers such as 2% and 3% cash back for buying Apple products using Apple Pay in addition to the Daily cash back reward after every spending, laser etching privacy technology with no card number, security code, or expiration date printed makes this card a standout amid others. The card will be digital financial disrupter in terms of its robust and friendly user interface that will give a hard-hitting competition to the overall existing payment system in India. In addition to all these, the access to instant credit facility may be an uncompromising aspect that no other Fintech company provides and will make them to think off with the coming of the Apple Cards.

Implications: Using Apple Credit Cards in India

The Apple Credit Card is only launched in the US market; there is no word as to when the service will roll out in the Indian markets. But, even if the Apple credit card comes to India in the near future, the service will face challenges from small merchants due to the current regulatory framework that requires the Fintech companies to follow basic necessary compliances such as linking Aadhaar, fulfilling KYC norms, registration with banks, RBI guidelines and other tedious procedures.

But on the other hand the card may also receive wide acceptance to the Indian Apple users in this digitally evolving economy. Due to the demonetization of Rs 1,000 and 500 notes, the Fintech industry in the country has already witnessed enormous boost in the digital sector, with Paytm, PhonePe and other homegrown apps sweeping their businesses backing a revolution in the Indian digital economy.

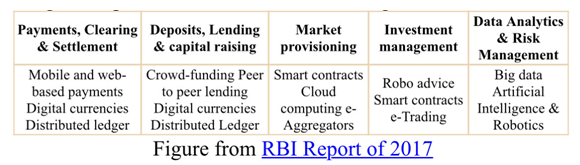

Since there is no generally accepted Fintech structure in India, the general parlance of Fintech can be categorized as:

iPhones will become Credit Cards

By studying the aforementioned category, we can say that the Apple Credit Card as a payment based system on mobile technology will enable the user’s mobile device to act as their credit cards. While this type of innovation may act as a new entrance to the financial system in the Indian as well as the Global financial market, it may also prove as a threat to the established non-banking companies that are not regulated as financial entities.

There are presently number of web-based payments system applications that provide transaction services interlinked with Payer’s Own Payment Service Provider (PSP) or by Third Party Services (TPS). These payments system do not provide banking services but are only limited to exchange of money within the commerce value chain. With the entrance of Apple credit cards in India, connecting the payers and merchants will integrate the transactions by simplifying the payer’s online banking credentials but without any Digital Signature/ Card Verification Value (CVV) etc.

These Credit cards will not only enable access to faster credit services but also help in reducing banking costs, reduce counterparty risks, cut tedious banking procedures, remove third party intervention, maintain easily accessible account and data collecting system, better fraud prevention, security and privacy as well as increased interconnectedness among other benefits.

The credit card based on peer-to-peer network system with potentially broad applications in Financial Market Infrastructures (FMIs) and in the economy as a whole as a source of making credit payments ensuring efficiency and security, over existing technological solutions. Given the significant potential change in peer-to-peer transactions, the Apple Credit cards will allow the Apple users to speed up the loan acceptance process, to reduce the time involved in access to credit from brick and mortar banks.

Regulatory Framework

With the coming of Apple credit cards in the Indian market in future, there will be regulatory changes in the financial payment sector to accommodate the aspects of Fintech giants and the evolving technology it brings.

The existing regulatory Fintech laws in India is encompassed under the Payment and Settlement Systems Act, 2007 (PSS Act) and the Payment and Settlement Systems Regulations, 2008 (PSS Regulation). The Act and Regulation provide discretions to RBI empowering it to issue guidelines to be followed by the payment systems in India. But due to the archaic nature of Law, there is no such mention of Fintech Laws that can govern evolving technology of financial services.

The RBI has already set up an inter-regulatory Working Group for Fin techs that include representatives from various governmental bodies such as RBI, Securities, and Exchange Board of India (SEBI), Insurance Regulatory and Development Authority of India (IRDA), Pension Fund Regulatory and Development Authority (PFRDA) and rating agencies such as Credit Rating Information Services of India Limited (CRISIL) and other Fintech consultants. As per the National Association of Software and Services Companies (NASSCOM) reports the Fintech Service sector is expected to grow to USD 45 billion with an increase of 7.1% annual growth rate.

In furtherance, the RBI has planned out Payment and Settlement System Vision – 2018 to inculcate in the present Laws that cover various Fintech related aspects as follows:

- Issuance of in-principle approvals for Payments Banks

- The entry of non-banking financial institutions as technology and payment service providers

- Introduced Bharat Bill Payments System (BBPS)

- Published a consultative paper on Card Payment Infrastructure

- Issued a consultation on Peer to Peer (P2P) lending

- Issued Directions on Account Aggregators

- Authorized payment solutions provided by NPCI such as NACH, AEPS, IMPS, Unified Payment Interface (UPI)

- Given in-principle approval for the National electronic toll collection project.

- Set up the framework for the electronic Trade Receivables Discounting System (TReDS) to improve flow of funds to MSMEs.

The PSS Act, 2007 includes the definition of Payment System as “A system that enables payment to be effected between a payer and a beneficiary, involving clearing, payment or settlement service or all of them, but does not include a stock exchange”

Therefore, from the explanation of the provision it can be analyzed that the Apple Credit cards can be included into the ambit of Smart card operator underlined in the provision. Further, Section 17 of the same Act empowers RBI power to issue directions to payment systems and systems participants. Therefore, it may be possible for the RBI to invoke the same provisions to Fintech technologies such as Apple Credit Cards when it comes to the Indian market.

Such credit card services will also be required to meet the necessary conditions as set out by RBI and Telecom Regulatory Authority of India (TRAI) for telecom related actives. The overlapping jurisdiction of such laws should meet the requirements of the PSS Act, 2007 as well as PSS Regulation, 2008, both of which includes provisions related to ATM networks, pre-paid instruments, wallet payments, card payment network as per RBI guidelines.

In addition to the aforementioned provisions and Laws, the Ministry of Electronics and Communications have also felt the urgency to regulate Prepaid Payments by issuing a draft Information Technology (Security of Prepaid Payments Instruments) Rules, 2017 that may include digitalized credit-based payment system. Be that as it may, since the draft is yet to pass, the old provisions and Laws will override it.

Conclusion

With the boom in Indian digital economy in empowering financial services, the coming of Apple credit cards may give a positive boost in leveraging the payment system as an innovative method of linking the virtual credit cards with the Immediate Payment Service in the Mobile (as a credit wallet feature). The users will now be able to carry virtual credit card by this revolutionary digital payment system and move towards “Less Cash” digitized society. It may also prove as an essential payment gateway instrument in the form of e-wallet to give the non-banking customers the facility to use the electronic modes of banking features.

However, the Apple Credit Card service may some face-offs in terms of fulfilling eligibility criteria to obtain such authorization from the RBI and other existing legal frameworks. Most of the provisions and Laws are framed in such a way that requires the entities to comply with some tedious procedures such as obtaining licenses, minimum capitalization norms, RBI approval etc. As this sector is developing rapidly, it is important to keep eye on such evolving payment systems such as Apple Credit Cards and its benefits in terms of existing payment system.

Author: Mr. Shubham Borkar, Senior Associate – Litigation and Business Development and Pranay Bhattacharya – Intern, at Khurana & Khurana, Advocates and IP Attorneys. In case of any queries please contact/write back to us at shubham@khuranaandkhurana.com.