INTRODUCTION

A Committee under the chairmanship of Mr. Injeti Srinivas formed by the Ministry of the Company Affairs (“MCA”) gave their recommendations to relook the offences under the Companies Act, 2013 (“Act”). Consequently ,The Ministry of Law and Justice had came out with an Ordinance dated 2nd November, 2018, further amending 31 provisions of the Act. Ordinance will cease to operate on 21st January, 2019. Since the Bill to make amendments to the Companies Act, 2013, is pending in the Rajya Sabha, the ordinance has been re-promulgated.Hence,the Government of India has re-promulgated an ordinance to amend the companies law to further improve the ease of doing business as well as ensure better compliance levels.

Overall 29 sections are amended and 2 new sections have been added through the previous ordinances, which were promulgated on 2nd November, 2018 (Ordinance 9 of 2018) and on 12th January, 2019 (Ordinance 3 of 2019).

SOME OF THE MAJOR AMENDMENTS AND IMPACT ON THE CORPORATE SECTOR

- In Section 2(41) of the Companies Act, the application for approving a change in financial year which was earlier to be made to “Tribunal”, now will be made to the “Central Government”.

- Commencement of Business -The Ordinance will put restriction on every company (incorporated post commencement of the Ordinance), to not to commence its business or exercise borrowing powers unless the directors file a declaration within a period of 180 days from the date of incorporation to the effect that every subscriber to the memorandum has paid the cost of the shares and the registered office is confirmed by filing required returns with the Registrar. Noncompliance, may be an extra ground for Registrar to strike off of the name of the company.

- Physical Verification- Registrar of Companies is now empowered vide a sub- section (9) to physically verify of the registered office on reasonable cause to believe that whether a business or operations is being carried out by the company. In case of any non- compliance of sub- section (1) in respect of having such an office in place is found, the same may also be an additional ground for Registrar to strike off of the name of the company.

- Alteration of Articles- The application for Alteration of the Articles to give effect to conversion of a public company to a private company which was earlier made to the Tribunal, now needs to be sent the Central Government.

- The creation of charges has to be registered within 30 days of creation which, on an application, may be extended by the Registrar to additional 30 days (existing provisions provided 270 days on payment of additional fee). In case of failure to register within the additional time of 30 days, the Registrar may, on an application, allow an additional period of 60 days from the date of application for which an ad valorem fee shall be levied.

- Punishment of contravention -Apart from the existing penal provisions on any contravention of the provisions of the chapter, any wilful furnishing of false or incorrect information or knowingly suppression of any material information pertaining to registration of charges shall tantamount to be a fraud and shall attract action under Section 447.

- Company or the person aggrieved by the order of the Tribunal may make an application to the Tribunal for relaxation or lifting of the restrictions placed under sub-section 8, within 1 year.

- Disqualifications of director –A new clause has been inserted under the Section linking Section 165, which shall be a ground for disqualification of a director, if he/ she breaches the limits of maximum directorship allowed there under. It is pertinent to note that falling under any of the clauses of Section 164 leads to automatic vacation of office that too, from all the existing companies. This is one of the significant provisions which need immediate attention.

- The Ordinance has increased the limit of offence for compounding before the Regional Director from 5 Lakhs to 25 Lakhs.

- The Power of the Adjudicating Authority has been expanded and the existing section empowered the adjudicating officer to impose penalty, by an order, on the company and the officer who is in default in case of any non- compliance or default of the provisions of the Act, however, such an order may henceforth be included any other person too, Further, the order of the adjudicating officer may also provide for rectification of the default by the concerned person. The penal provisions as provided in sub- section (8) shall apply to violation in compliance of the said order also.

- Penalty for repeated default-This newly inserted section provides for penalty of twice the amount of penalty in case of repeated defaults(repeated within 3 years from the date of order imposing penalty for earlier default) by companies or any person who had already been subjected to penalty under the Act.

CHANGES IN THE PENAL PROVISIONS

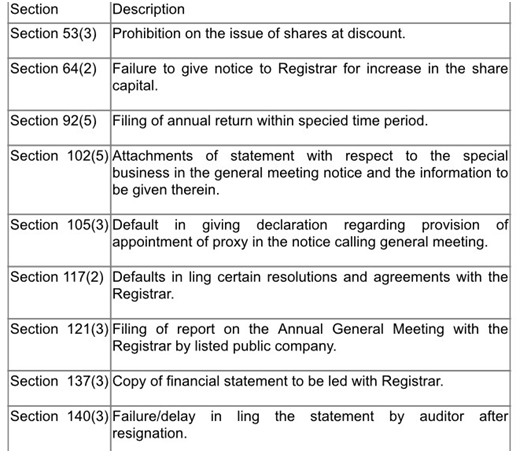

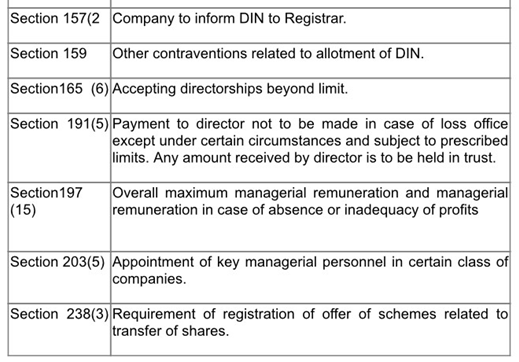

The changes that have been brought in the penal provisions have been consolidated in the following table for ready reference:

As per the Current ordinance the following 16 out of 81 Compoundable Offences shall now be liable to penalty instead of being punishable with imprisonment.

Author: Mr. Shubham Borkar, Senior Associate – Litigation and Business Development and Lakshay Kewalramani –Intern, at Khurana & Khurana, Advocates and IP Attorneys. In case of any queries please contact/write back to us at shubham@khuranaandkhurana.com or at www.linkedin.com/in/shubhamborkar.